The tool, created to help countries reach their pollution reduction targets, has led to growing corporate interest in the Amazon. Find out why

Why are we talking about this?

Few topics in the debate on the climate crisis stir up as much passion as so-called “carbon credits.” There are those who feel that they will unlock abundant funding, through which Brazil could receive billions. But there are also those averse to carbon trading, who say that “the market is incapable of taking responsibility for life on the planet” and that this type of business is the same thing as putting nature up for sale. It’s neither one nor the other: carbon credits are just a tool to make it easier to reach the climate goals in the Paris Agreement. As with any tool, they can be put to good use or they can be misused.

What is carbon?

To understand carbon credits, you first need to understand why carbon is important. Human activities such as deforestation and the burning of gasoline and diesel emit excess gasses that trap the Earth’s heat in the atmosphere. The most prevalent of these so-called greenhouse gasses is carbon dioxide, or CO2. In the right amounts, it is crucial to the quality of life on Earth. The problem is that in the last 200 years, following the Industrial Revolution and with growing deforestation in the Amazon and in other forests, the planet has overdosed on greenhouse gasses. Average temperatures are rising and the climate is unstable, with droughts and extreme storms. As a result, people are suffering and dying, especially in peripheral areas and poorer communities, which have less structure to protect against catastrophes.

And how can the problem be solved?

In 1992, an international agreement known as the UN Convention on Climate Change was signed in Rio de Janeiro to prevent the worst consequences of the greenhouse effect. In 1997, representatives from over 160 countries met in Kyoto, Japan to come up with a protocol to put the agreement into practice. In the Kyoto Protocol, the so-called “developed” nations committed to cutting 5.2% of their climate-polluting emissions by 2012, compared to 1990 levels. In 2015, the Paris Agreement was signed, stipulating that countries need to cut emissions to keep the Earth from warming by more than 1.5 degrees Celsius in relation to the pre-Industrial Revolution period.

And where do carbon credits fit into this?

The Kyoto Protocol had a range of tools to enable countries to reach their goals. For instance: if a certain nation needed to cut a given volume of emissions, but doing this domestically would be too costly, that country could purchase some of what needs to be cut from another country where reducing emissions is cheaper, as long as that country has already exceeded its own reduction goal.

Let’s consider a completely hypothetical case: say that Germany and Portugal each have a goal to cut 100,000 metric tons of CO2 in a particular year. Germany was only able to cut 95,000, but Portugal surpassed its target, lowering its emissions by 105,000 metric tons. In this case, Portugal could sell these 5,000 excess tons to Germany as “credit” to Germany. From the vantage point of the atmosphere, it doesn’t matter if CO2 is emitted in one country or another; what matters is that a total of 200,000 metric tons were cut by both countries. This means that the carbon credit is a right to pollute that can be transacted between nations that have emissions reduction targets to meet.

But why do these transactions reduce emissions?

The carbon market itself does not remove one single gram of greenhouse gas from the air: it just shuffles this carbon from one side to another, according to the laws of the market, which is to say, it goes wherever it is cheaper and more efficient to make cuts. Yet by doing this, it helps to spread clean technologies and makes them more affordable. How? Take an example of an initiative in the city of São Paulo: in the early 2000s, São Paulo installed power plants in its landfills, burning the methane emitted by decomposing trash and using this gas to produce electricity. If it were not burned, the methane would go straight into the atmosphere; however, by capturing it to generate energy, São Paulo made an additional contribution to fighting the climate crisis (because without the project, there would have been twenty-eight times more pollution) and the city could issue carbon credits on the international market. This brought in funds that could be invested in similar projects, spreading power generation to other landfills and preventing more methane emissions, in a virtuous cycle.

What types of carbon markets are there?

The 2015 Paris Agreement created a carbon market that is international and regulated, but which has still not been implemented to this day. Markets continue to be national or regional, like the European Trading Scheme (ETS), which is restricted to European Union countries.

After Paris, the world gained a regulated market that has yet to begin operating, but which is split in two: credit exchanges between countries (regulated by Article 6.2 of the agreement) and credits generated by projects (regulated by Article 6.4). In this second modality, any public or private institution can offer carbon credits on the market, provided they undergo close examination by an international authority and the credits sold are not used by the country hosting the project toward its own goal.

There is also a carbon credit modality that is not in the Paris Agreement rules: the so-called voluntary market. In this segment, companies and government organizations looking to convey a good image to shareholders or that want to fulfill prerequisites for obtaining international certifications for good practices simply fund projects to reduce emissions in other regions or countries. In these cases, there is no government regulation or control, which can make it easier for fraud to occur.

Where does the Amazon fit into all of this?

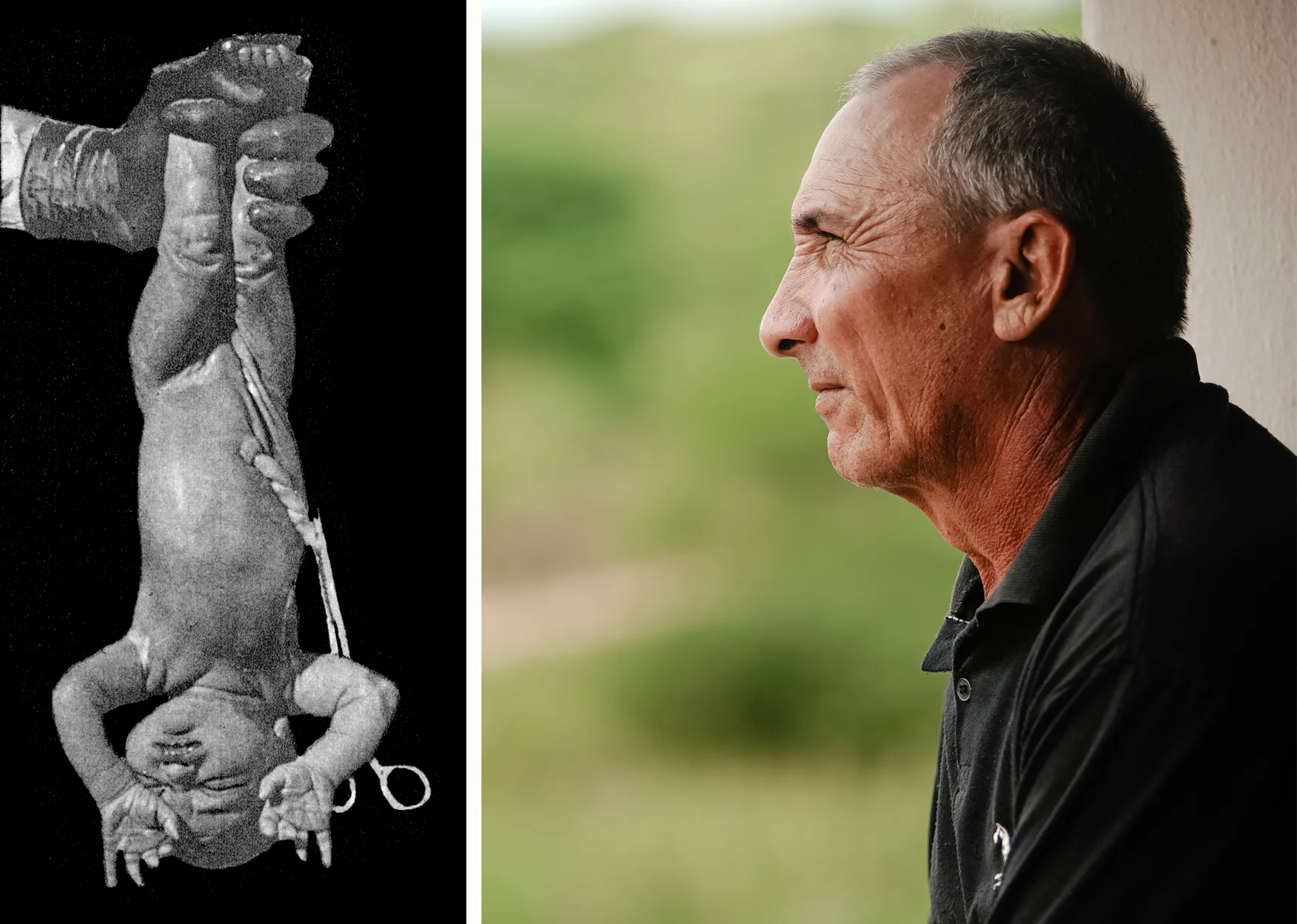

Well, the rainforest stores the equivalent of 442 billion metric tons of CO2, an amount comparable to eight years of global emissions. Reducing deforestation is therefore a powerful way to cut emissions. Preventing one metric ton of CO2 from being emitted by the removal of trees in any area of the forest is much cheaper than, say, cutting this same metric ton by reducing the amount of fuel used to heat Europe in the winter.

The Amazon has therefore been seen as a source for generating carbon credits through REDD+, the acronym for Reducing Emissions from Deforestation and Forest Degradation. There are several REDD+ projects already operating in the region, all on the voluntary market. These projects are certified by private entities and can compensate states, municipalities, or communities that prevent or reduce deforestation or recover forests. There are also voluntary market projects where private property owners can claim credits by agreeing not to clear the area they are legally entitled to deforest (20% of forest area on private properties in the Amazon).

The Brazilian government is also piloting one of the world’s biggest REDD+ projects, the Amazon Fund, through which Norway and Germany make contributions to Brazil whenever the country’s deforestation rates are below a particular level. None of these projects let donor countries or companies, or the buyers of the “credits,” subtract the reduced deforestation emissions from their goals.

Is using forests to generate credits a good idea?

A variety of civil society organizations, like Greenpeace, are against the carbon market. They argue, with reason, that the unchecked sale of cheap forest credits would give wealthy countries a free pass to continue burning fossil fuels and to not make the necessary transformation in how they produce and use energy. Greenpeace is not alone: the Brazilian government has always been against using REDD+ as a mechanism for buyers to use credits to put toward their targets (what is known as an offset).

There is also the danger of perverted incentives: because areas at greater risk of deforestation generate more credits (since their protection is supposed to be “additional,” which is to say, if there were no project, the area would be deforested), this can discourage reduction of deforestation around a carbon project in these regions.

Where has the carbon market worked well?

The world’s best example of a functional carbon market does not involve forests: it is the ETS, the European market, which has been operating since 2005 and involves the economic sectors causing emissions on the continent – energy and industry. Regulated companies are given an annual cap in the European market and they are able to exchange pollution permissions with each other. Polluting beyond their cap means incurring hefty fines, so there is an incentive to trade permissions. Companies that cut more emissions in their own production chain can sell credits to those who were unable to achieve reductions and who want to avoid fines. According to the European Commission, the ETS managed to lower emissions at participating companies by 35% from 2005 to 2021, which would not have been possible without the market.

Where have things gone wrong?

Some carbon credit projects show up over and over in reports of fraud, for lacking additionality (that is, when payments are made to projects that neither remove nor prevent more emissions than if there were no project) or in what are known as “green land-grabs” of public lands, as shown by Sumaúma in June 2023. The year before, a report in The Guardian newspaper found that 90% of the forest carbon credits certified by the world’s largest company of this kind could be “worthless,” or rather, they do not reflect actual reductions in deforestation. When they are used as offsets by oil companies, these fake credits mean more emissions and more global heating.

Illustrations: Hadna Abreu

Fact check: Plínio Lopes

Spell check (Portuguese): Elvira Gago

Translation into Spanish: Meritxell Almarza and Julieta Sueldo Boedo

English translation: Sarah J. Johnson

Page setup: Érica Saboya